ALL YOUR DATA IN ONE PLACE

ACROSS THE LIFE OF THE ASSET®

DEBT INVESTMENTS

LOAN ASSET MANAGEMENT

Gain fast access to reliable information

Experience better insights and faster reporting times, elevating your asset management by having all your data in one place, allowing commercial loan asset managers to see data from:

- Loan-level leveraged and unleveraged cash flows.

- Loan servicing details.

- Interest rate data.

- Collateral management with property financials and occupancy metrics.

- Capital stack reporting.

- Track Borrower and Guarantor information.

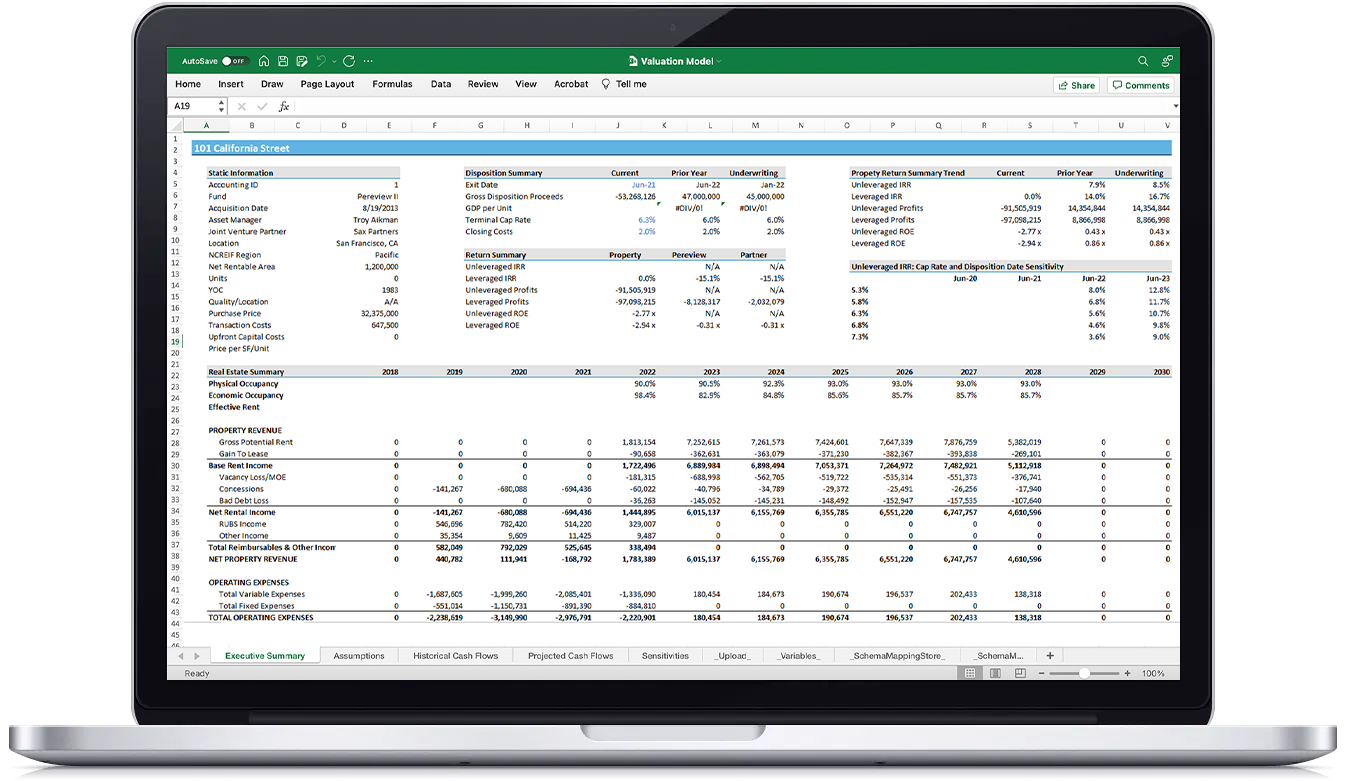

- Connect your asset-level Excel models to Pereview to update annual business plans, download historical financials, update projected cash flows, change assumptions, etc.

PORTFOLIO & FUND MANAGEMENT

Aggregate information across all assets

Pereview offers the ability to see how your overall portfolio is performing, offering an exclusive insight into each loan or asset.

- Readily know your exposure by borrower, property type, region and more.

- Quickly determine the balance of your portfolio that is fixed vs. floating interest rate.

- Understand loan-level maturities and other covenant details.

- Aggregate loan-level cashflows throughout the portfolio.

- Automate all your internal management and external investor reporting.

TRANSACTION

Transaction management made easy

Pereview provides a simple and seamless system to keep track of your assets and manage complex transactions by centralizing scattered Excel files.

Originations Pipeline

Pereview automates your originations pipeline reporting. With one click of a button, you can easily see the status of every deal in your pipeline, sorted by status, acquisition officer and more.

Screening / Underwriting

Pereview supports your ability to connect your Excel model to your Pereview database for a secure two-way data transfer, enabling you to:

- Store multiple underwriting scenarios.

- Track how underwriting assumptions and cashflows change as the deal progresses.

- Report on actuals to underwriting once you close on the deal.

Financing

Conveniently track where you are in financing your investment – lender selection, rate lock, under contract, etc. – and then finalize the process once the investment is closed.

Closing

Excel Modeling

Excel is the best modeling tool but not the best database.

Bring your unique Excel models (underwriting, valuations, asset-level business plans, portfolio/fund model, joint venture, promote models, etc.) and connect to Pereview for a two-way, secure transfer.

- Collect data with ease and compare how deals are actually performing vs. how you originally underwrote it.

- Run complex analytics and reporting on all your underwriting and valuation data.

- Confidence that your data is secure.

Reporting done your way

No two real estate companies do real estate the same way. Pereview provides customizable dashboards and reports to fit the way you do business.

Out-of-the-box library

Extensive library of standard reports available to you on day one.

Customization throughout the system

Dashboards to view all your metrics. Automate investor and management reports. Powerful ad hoc views to answer any question your organization or customers may have.

Fingertip analysis

With all of your data across the entire life of the asset in Pereview, advanced analytics and deep insights are just a click away.

Visual KPIs

Pereview combines everything an asset manager needs to track what matters, freeing up valuable time to focus on increasing asset performance.

Experience the ease of a modern platform

Pereview ensures you capture your data in a singular, secure platform. No other CRE platform provides individualized solutions for seamless complex data integrations from any system.

- Integrate with other systems with Pereview’s robust APIs to import and export data

- Bring in your data from third-party property managers, Operating Partners, your own internal systems, etc.

- Guarantee that your data is clean, secured, and governed to the standards of your customer with built interfaces, leveraging APIs, or even from Excel

Data Management Services

Pereview’s Data Management service is designed to manage the process of receiving, validating and uploading data from borrowers for you.

Give your team back valuable time